Debt Buying with EverChain

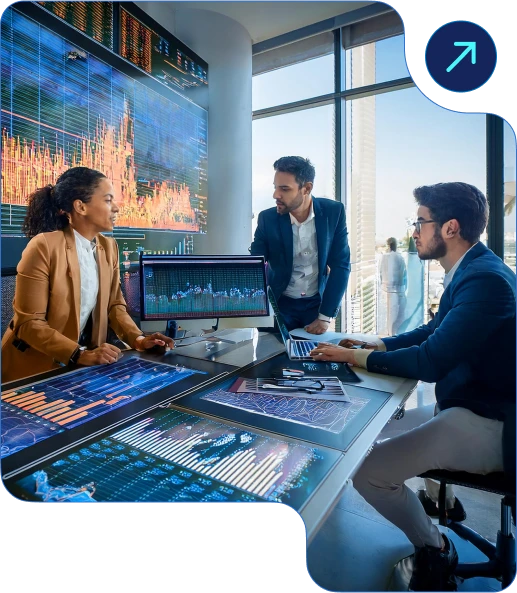

Looking for fresh forward flows or aged warehoused portfolios?

EverChain connects you to rigorously vetted opportunities and cutting-edge tools to transform every step of the buying process. With a trusted platform designed to help you scale in a competitive market, EverChain puts quality, efficiency, and growth within your reach.

Discover High-Quality Portfolios with EverChain

EverChain offers direct access to portfolios from global financial institutions and trusted credit issuers. Each seller undergoes rigorous vetting to ensure compliance, accuracy, and quality, empowering you with opportunities that align with your goals.

Showcase your products to a wide array of potential clients, from large financial institutions to specialized collection agencies.

Deals close in half the time for Certified Debt Buyer Network members.

Choose from warehouse files, one-time sales, or forward-flow arrangements.

Simplifies and accelerates the deal process.

Keeps your bids private and secure.

Access robust stratification reports and seller due diligence.

Secure consistent supply and predictable growth.

Simplify Every Step of the Buying Process

EverChain integrates efficiency into every interaction, from real-time bidding to automated processes, enabling you to focus on scaling your business.

What Makes EverChain Different?

Your bids stay confidential, ensuring fair competition.

Instantly access compliance, media, and performance data.

Streamline acquisitions with a unified system of record.

Achieve Success Beyond the Purchase

EverChain ensures you stay supported after the deal closes with advanced tools and responsive communication.

Manage everything seamlessly and eliminate post-sale headaches.

Resolve issues quickly through integrated chat functionality.

Ensure standards are met by your agency network.

From portfolio tracking to strategic adjustments, EverChain maximizes recovery and simplifies post-sale management.

Tools and Analytics to Fuel Your Success

EverChain equips debt buyers with data-driven insights and customizable tools to optimize acquisition strategies and portfolio management.

Actionable Analytics

Custom Dashboards

Expert Guidance

Ready to revolutionize your recovery efforts?

Contact EverChain today and discover how we can help you recover more, buy smarter, and simplify recovery with the power of our network.