Recent studies, including a detailed report by Experian and the latest data from the Federal Reserve Bank of New York, highlight significant shifts in the landscape of consumer debt in the United States. These changes, characterized by increasing charge-offs and delinquencies, underscore the need for lenders to develop comprehensive strategies to effectively address these challenges.

A Closer Look at Current Debt Trends

Last year saw U.S. consumer debt rise to over $17.1 trillion—a 4.4% increase, although slower than the previous year’s 7% growth. Notably, credit card debt jumped by 17.4%, driven by more consumers spending and carrying balances.

The Federal Reserve Bank of New York also reported an uptick in delinquency rates, with 3.1% of outstanding debt in some stage of delinquency as of December 2023.

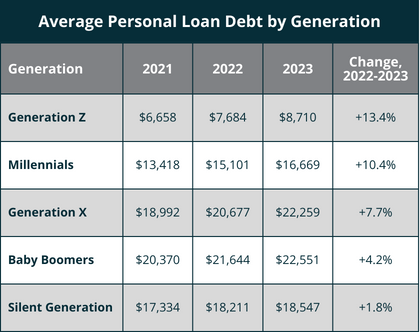

Interestingly, when breaking down personal loan debt by generation, distinct borrowing behaviors emerge that offer a window into the financial dynamics unique to each age group (see table).

This data points to the urgent need for lenders to reevaluate their risk management and debt recovery approaches.

Effective Strategies to Manage Rising Delinquencies and Charge-Offs

Adopting some of the following strategies can help manage or reduce the frequency of delinquencies and charge-offs:

-

Enhanced Credit Risk Assessment

Leveraging data analytics, predictive modeling, and machine learning can significantly sharpen credit risk assessments, allowing lenders to consider a broader range of data points and better predict potential delinquencies.

-

Dynamic Account Management Tools

Tools that monitor signs of financial distress can help identify at-risk accounts early, enabling timely interventions.

-

Personalized Communication Strategies

Tailoring communications to address each borrower’s unique circumstances can help avert delinquencies by offering relevant financial advice and flexible payment options.

-

Proactive Loan Modification Programs

Modifications and restructuring plans tailored to individual needs can aid borrowers in managing their payments more effectively, thus mitigating default risks.

-

Financial Literacy and Counseling

Investing in programs that boost financial knowledge can empower borrowers to better manage their debts, potentially preventing future delinquencies.

The Benefits of Liquidating Non-Performing Debt

Selling non-performing loans to qualified buyers within the EverChain network provides several benefits:

-

Immediate Financial Recovery

Liquidation translates into quick capital recovery from defaulted debts, which can then support more productive lending activities.

-

Non-Dilutive Capital

Selling debt adds non-dilutive capital to the organization, enhancing financial leverage without affecting equity shares, an attractive prospect for FinTech companies focused on growth and valuation sustainability.

-

Risk Reduction

Offloading delinquent debts helps minimize the risk of asset value deterioration and reduces exposure to non-performance.

-

Operational Efficiency

Divesting from the intensive process of managing delinquent accounts allows lenders to focus on core business operations, boosting profitability.

-

Regulatory Compliance and Brand Protection

Working with compliant, qualified debt buyers ensures adherence to regulatory standards and preserves the lender’s brand integrity.

-

Consumer Protection

EverChain’s commitment to ethical debt recovery practices guarantees fair treatment of consumers, maintaining trust and compliance with regulations.

-

Strategic Advisory

Beyond transactional support, EverChain offers strategic guidance to optimize debt recovery and portfolio management.

Conclusion

The escalating consumer debt and the resulting rise in delinquencies and charge-offs call for a multi-faceted approach from lenders. By adopting robust risk assessment tools, personalized engagement strategies, and considering the liquidation of non-performing assets through a trusted partner like EverChain, lenders can protect their financial stability while enhancing operational efficiency and upholding consumer trust.

EverChain remains dedicated to assisting lenders through these challenging times with our comprehensive suite of services, ensuring the best outcomes for all involved parties. To discover how EverChain can boost your strategy for selling debt and to see our platform in action, reach out to our team today.