The Landscape of Debt in America: Insights & Figures for 2023

Let’s dive into a topic that touches almost every American: debt. We’re nearing the end of 2023, and the financial landscape has some staggering numbers to digest. The total household debt in the U.S. soared to a jaw-dropping $17.06 trillion in the second quarter of 2023, with credit card debt alone reaching $1.03 trillion, according […]

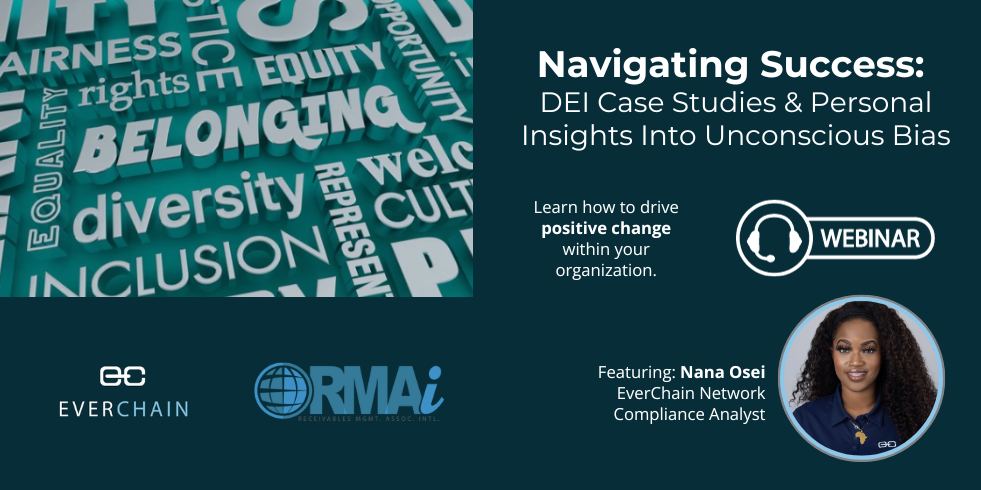

Navigating Success: DEI Case Studies and Personal Insights into Unconscious Bias

Join EverChain and RMAI for an engaging journey into Diversity, Equity, and Inclusion (DEI) with the webinar, “Navigating Success: DEI Case Studies and Personal Insights into Unconscious Bias.” This session isn’t just about the theory; it’s a deep dive into real-life stories and personal experiences that have shaped successful DEI practices in various organizations. This […]

Mastering Compliance: Strategically Elevate Your Regulatory Game Amid CFPB’s Enforcement Expansion

Mastering Compliance in a Changing CFPB Landscape: EverChain’s Approach In recent announcements from the Consumer Financial Protection Bureau (CFPB), we’ve learned about significant staff increases, particularly within its Enforcement Division. Currently, their Enforcement branch comprises approximately 150 enforcement attorneys and support staff. With the addition of 75 new full-time employees to this division, there will […]

Team Spotlight with Deborah Everly, Debt Sales Vice President

Team Spotlight with Deborah Everly For this month’s “Team Spotlight,” we are delighted to highlight one of EverChain’s newest team members, Deborah Everly. Deb’s been a leader at Viking Payment Service, Sequium Asset Solutions, Azimut Advisors, and Asset Acceptance Capital, and she takes great pride in developing and maintaining strong relationships with clients. We asked […]

From Sale to Success: How Robust Post-Sale Support Transforms Debt Buying Partnerships

From Sale to Success: How Robust Post-Sale Support Transforms Debt Buying Partnerships Following a debt sale, there are frequent requests for post-sale documents and media. Tracking a portfolio’s putbacks, buybacks, and communications can create a massive headache for both the seller and the buyer in the years that follow. As we often say, “A debt […]

Navigating the Complexities of Debt Sales: How Brokers Add Value

Navigating the Complexities of Debt Sales: How Brokers Add Value Creditors today are keen on expanding their recovery strategy. This often includes exploring debt portfolio sales to third-party buyers. But the process of selling debt often involves some hurdles, especially in establishing a fruitful, long-term relationship with a [fusion_tooltip title=”What’s a debt buyer?” class=”” id=”” […]

Liquidating Your Consumer Debt: How Creditors Benefit from Selling Charge-Offs

Liquidating Your Consumer Debt: How Creditors Benefit from Selling Charge-Offs Author: Matt Stone Navigating the complexities of consumer lending often leads creditors to an unavoidable challenge: charge-offs. While these defaulted accounts are typically written off as losses, they can actually become valuable assets when sold to debt-buyers. With EverChain’s expertise, lenders have successfully transformed these […]

Unlocking Value: A Guide for Selling Consumer Debt

Unlocking Value: A Guide for Selling Consumer Debt Author: Matt Stone Consumer lending offers lucrative opportunities but also comes with inherent risks. While the majority of borrowers fulfill their financial commitments, some loans inevitably become charge-offs, impacting your profitability. What if you could liquidate these non-performing loans, all while safeguarding your brand and bottom line? […]

State of the Debt Sales Market – CBA Webinar featuring TransUnion & EverChain

State of the Debt Sales Market – CBA Webinar featuring TransUnion & EverChain Evolving Creditor Strategies for Handling Non-Performing Loans. Did you miss our live webinar? Watch as EverChain’s Chief Executive Officer, Matthew Wratten, and TransUnion’s Director of Financial Services, Javier Alvarado, discuss the ongoing challenges in the debt sales market and offer strategies to […]

What’s a Debt Buyer?

What’s a Debt Buyer? If you’ve ever had a debt in collections, you may have experienced your account being purchased by a debt buyer. Debt buyers are businesses in the financial industry that partner with credit issuers to relieve some of the financial loss that can occur from lending money, goods, or services for which the […]