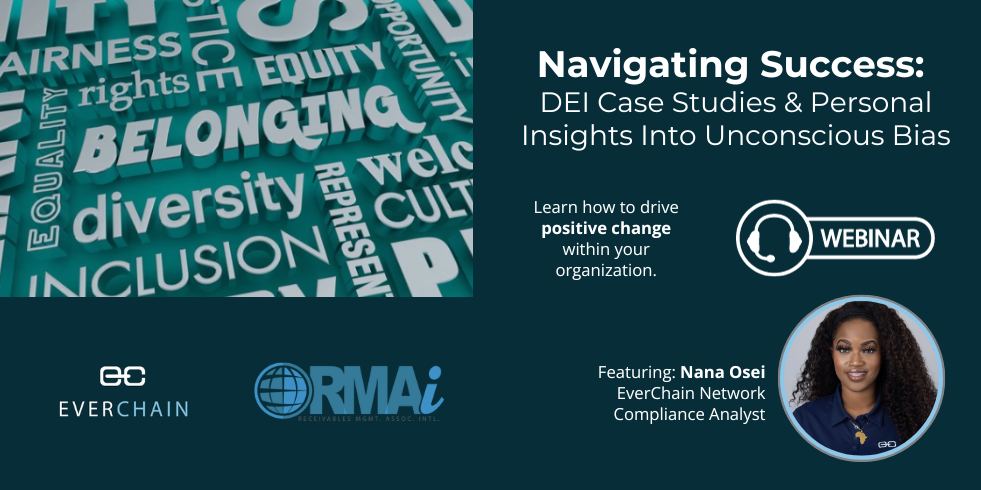

Navigating Success: DEI Case Studies and Personal Insights into Unconscious Bias

Join EverChain and RMAI for an engaging journey into Diversity, Equity, and Inclusion (DEI) with the webinar, “Navigating Success: DEI Case Studies and Personal Insights into Unconscious Bias.” This session isn’t just about the theory; it’s a deep dive into real-life stories and personal experiences that have shaped successful DEI practices in various organizations. This […]

Mastering Compliance: Strategically Elevate Your Regulatory Game Amid CFPB’s Enforcement Expansion

Mastering Compliance in a Changing CFPB Landscape: EverChain’s Approach In recent announcements from the Consumer Financial Protection Bureau (CFPB), we’ve learned about significant staff increases, particularly within its Enforcement Division. Currently, their Enforcement branch comprises approximately 150 enforcement attorneys and support staff. With the addition of 75 new full-time employees to this division, there will […]

State of the Debt Sales Market – CBA Webinar featuring TransUnion & EverChain

State of the Debt Sales Market – CBA Webinar featuring TransUnion & EverChain Evolving Creditor Strategies for Handling Non-Performing Loans. Did you miss our live webinar? Watch as EverChain’s Chief Executive Officer, Matthew Wratten, and TransUnion’s Director of Financial Services, Javier Alvarado, discuss the ongoing challenges in the debt sales market and offer strategies to […]

What’s a Debt Buyer?

What’s a Debt Buyer? If you’ve ever had a debt in collections, you may have experienced your account being purchased by a debt buyer. Debt buyers are businesses in the financial industry that partner with credit issuers to relieve some of the financial loss that can occur from lending money, goods, or services for which the […]

The 2023 State of Ransomware Report

An annual study of the real-world ransomware experiences of IT/cybersecurity leaders makes clear the realities facing organizations in 2023 The Sophos 2023 research report on ransomware reveals the most common root causes of ransomware attacks and shines new light on how experiences differ based on organization revenue. The report also reveals the business and operational […]

EverChain Jumpstarts European Expansion in the UK

EverChain Jumpstarts European Expansion in the UK. EverChain UK will leverage EverChain’s decade of experience and proprietary recovery management solution to bring compliant debt sales to the UK. July 19, 2022 – EverChain, the only consumer-centric Recovery Management Solution (RMS) for consumer lenders and creditors, today announced the initial phase of its international expansion strategy […]

Fintech Nexus Interviews EverChain’s Founder and Chief Executive Officer, Matthew Wratten

Fintech Nexus Interviews EverChain’s Founder and Chief Executive Officer, Matthew Wratten Listen to the Interview The debt-buying process is one that has traditionally been highly manual with Excel spreadsheets flying around and not much automation or sophistication. But that has started to change as fintech has come to debt buying and selling. My next guest […]

Taking Unnecessary Risks With Consumers’ PII?

ARE YOU TAKING UNNECESSARY RISKS WITH YOUR CUSTOMERS’ PII? As a lender, you are entrusted with large amounts of your customers’ PII (Personally Identifiable Information) and, according to several federal statutes protecting PII, you are responsible for the security of that data. As the originating creditor, you likely have security and access protocols in place […]

EverChain: Certified Receivables Vendor

EverChain: Certified Receivables Vendor We are pleased to announce that EverChain has once again met the requirements and earned the designation of an RMAI “Certified Receivables Vendor” (CRV). As a designated CRV, our organization will continue to uphold the policies and procedures outlined in the Receivables Management Certification Program Governance Documents. EverChain was the first […]

Tips for Compliantly Buying Debt

Tips for Compliantly Buying Debt This article was published in Cornerstone’s newsletter on April 19. Table of Contents 5 TIPS FOR MITIGATING RISK WHEN BUYING DEBT 1. Strategy 2. Segment 3. Security 4. Due Diligence 5. Post-Sale 5 OBSTACLES THAT PREVENT CREDITORS FROM SELLING DEBT 1. Perception of Risk: 2. Lack of Resources: 3. Lack […]